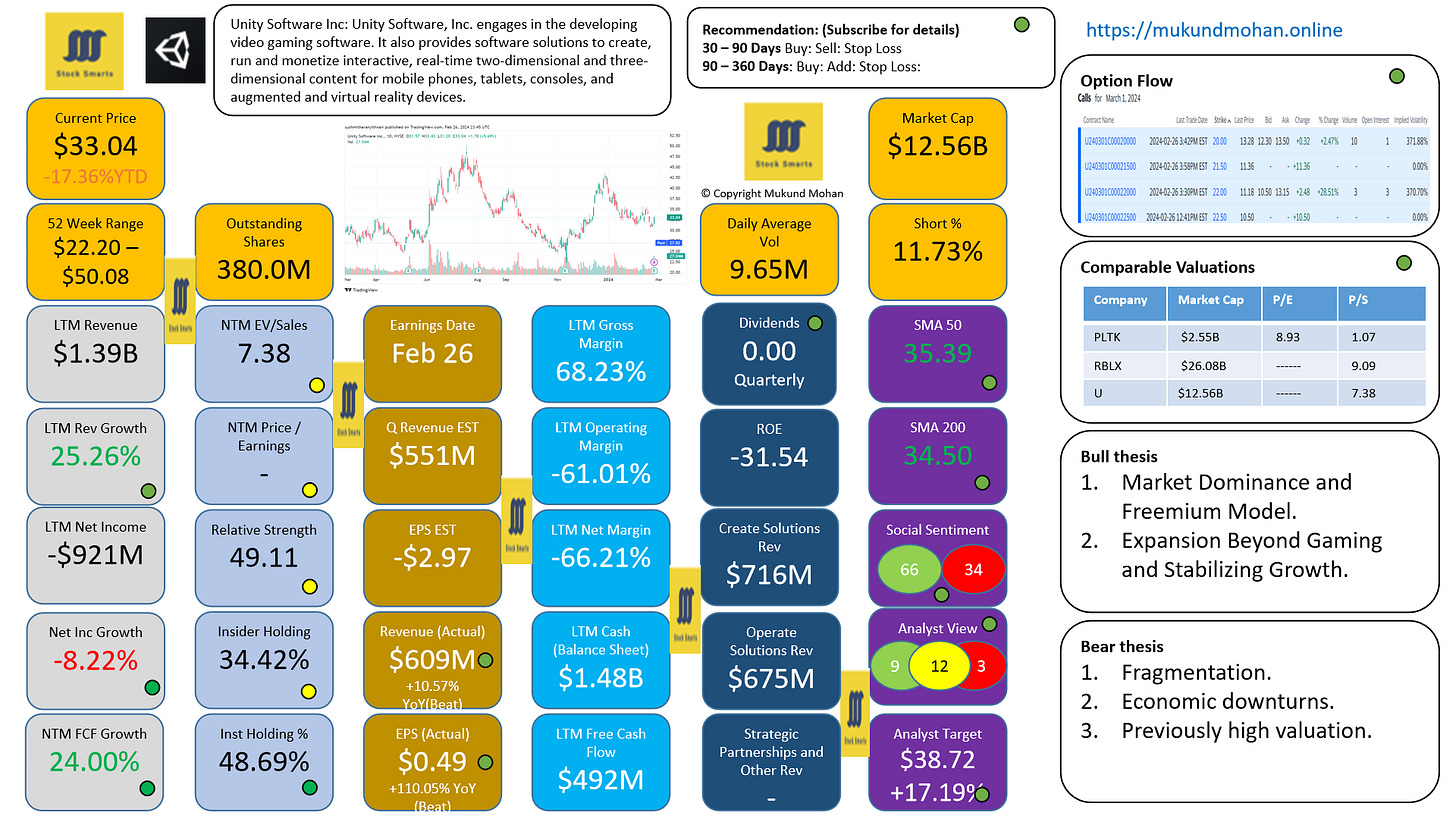

$U Unity Software Inc Deep Dive and 2024 Outlook

Will the earnings be a damper or a good entry point for the stock?

Unity Software Inc., also known as Unity Technologies, is a software game technology company based in San Francisco, California. It specializes in providing a real-time 3D (RT3D) development platform, which empowers developers to create immersive and interactive experiences across 2D, 3D, virtual reality (VR), and augmented reality (AR) environments. Unity's product suite includes Unity Plus, Unity Enterprise, Unity MARS, Unity Build Server, Pixyz, Optimization Accelerator, and tools for multiplayer games, among others. These offerings cater to a wide range of industries, including architecture, automotive, construction, engineering, film, and gaming.

Unity reported earnings on Feb 26th. In this report, Unity Software announced earnings per share (EPS) of -$0.66 for the quarter, which missed the consensus estimate of $0.23 by $0.89.

The company reported revenue of $609.27 million for the quarter, surpassing analyst estimates of $551.01 million. This revenue figure represents a 35.1% increase compared to the same quarter in the previous year. Unity Software has generated -$2.32 earnings per share over the last year and is expected to see earnings growth in the coming year, with forecasts suggesting an improvement from -$0.67 to -$0.52 per share. The big questions for Unity are:

Can the company improve profit margins and demonstrate better capital management while maintaining growth?

How successful will Unity be in recovering its advertising business through the merger with ironSource?

How will Unity balance growing its user base with increasing revenue through subscriptions, asset store sales, or other methods?

Keep reading with a 7-day free trial

Subscribe to Stock Smarts to keep reading this post and get 7 days of free access to the full post archives.