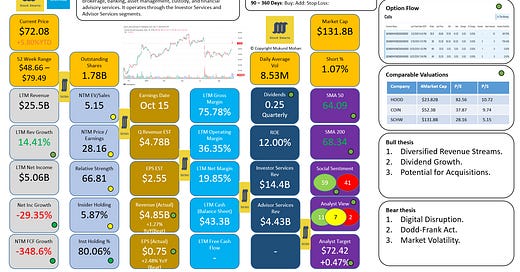

$SCHW Charles Schwab Corporation Deep Dive and 2024 Outlook

The discount broker is starting to move higher on trading revenues

The Charles Schwab Corporation, founded in 1971 by Charles R. Schwab, is a leading financial services firm headquartered in Westlake, Texas. It operates primarily as a savings and loan holding company, offering a comprehensive range of brokerage, banking, and financial advisory services.

Products:

Brokerage Accounts: Featuring options for equity, fixed income, and options trading.

Mutual Funds and ETFs: Commission-free trading for proprietary and third-party funds.

Banking Services: Including checking and savings accounts, mortgages, and home equity lines of credit.

Wealth Management: Customized financial advice and portfolio management solutions.

Schwab leverages advanced technology to enhance customer experience with platforms like Thinkorswim for trading and Schwab Intelligent Portfolios for automated investing. They serve a diverse clientele ranging from individual investors to institutions, emphasizing accessibility and education. They aim to provide tools that empower clients to manage their investments effectively. Their operations are in the U.S., U.K., Singapore, and Hong Kong, Schwab is positioned in the competitive landscape of financial services, focusing on low-cost investment solutions to attract a broad market base.

The big questions for Charles Schwab Corporation Limited and the stock in 2024?

How effective are Schwab's recent technology investments?

How will interest rate changes impact profitability?

What is the outlook for market volatility?

What are the implications of regulatory changes?

What is the competitive landscape in financial services?

Keep reading with a 7-day free trial

Subscribe to Stock Smarts to keep reading this post and get 7 days of free access to the full post archives.