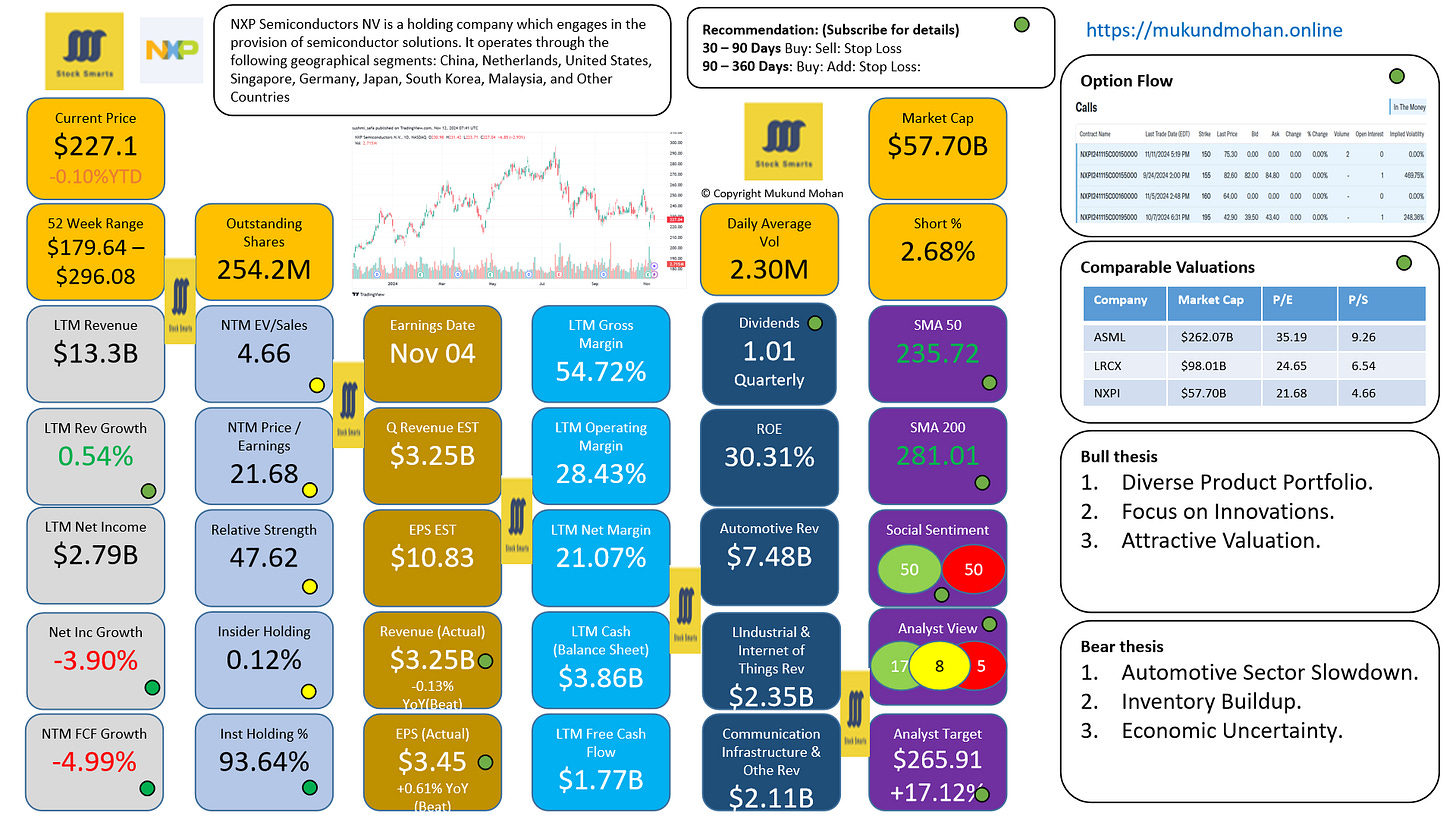

$NXPI NXP Semiconductors N.V. Deep Dive and 2024 Outlook

The semiconductor company is not benefiting from the upswing because of slower EV demand

NXP Semiconductors N.V., founded in 2006 as a spin-off from Philips, specializes in high-performance mixed-signal and standard product solutions. The company operates across various sectors, including Automotive, Industrial & IoT, Mobile, and Communication Infrastructure. NXP is renowned for its contributions to automotive electronics, particularly in areas such as advanced driver-assistance systems (ADAS), secure car access, and infotainment systems, making it a leading supplier in the automotive semiconductor market.

NXP’s product portfolio includes microcontrollers, secure identification solutions, and connectivity solutions like NFC technology, which enables secure mobile payments. The company serves a diverse customer base, including major OEMs such as Apple, Samsung, and Bosch, with a focus on fostering long-term relationships through tailored solutions and support.

Despite supply chain management challenges, they are in strong demand in the automotive and IoT sectors. The company's strategic emphasis on innovation and collaboration positions it well within the competitive semiconductor landscape.

The big questions for NXP Semiconductors N.V. and the stock in 2024?

What are the implications of NXP's recent earnings reports?

What impact will NXP macroeconomic trends have on revenue growth?

How will supply chain challenges affect production and profitability?

How will NXP navigate the competitive semiconductor landscape?

Keep reading with a 7-day free trial

Subscribe to Stock Smarts to keep reading this post and get 7 days of free access to the full post archives.