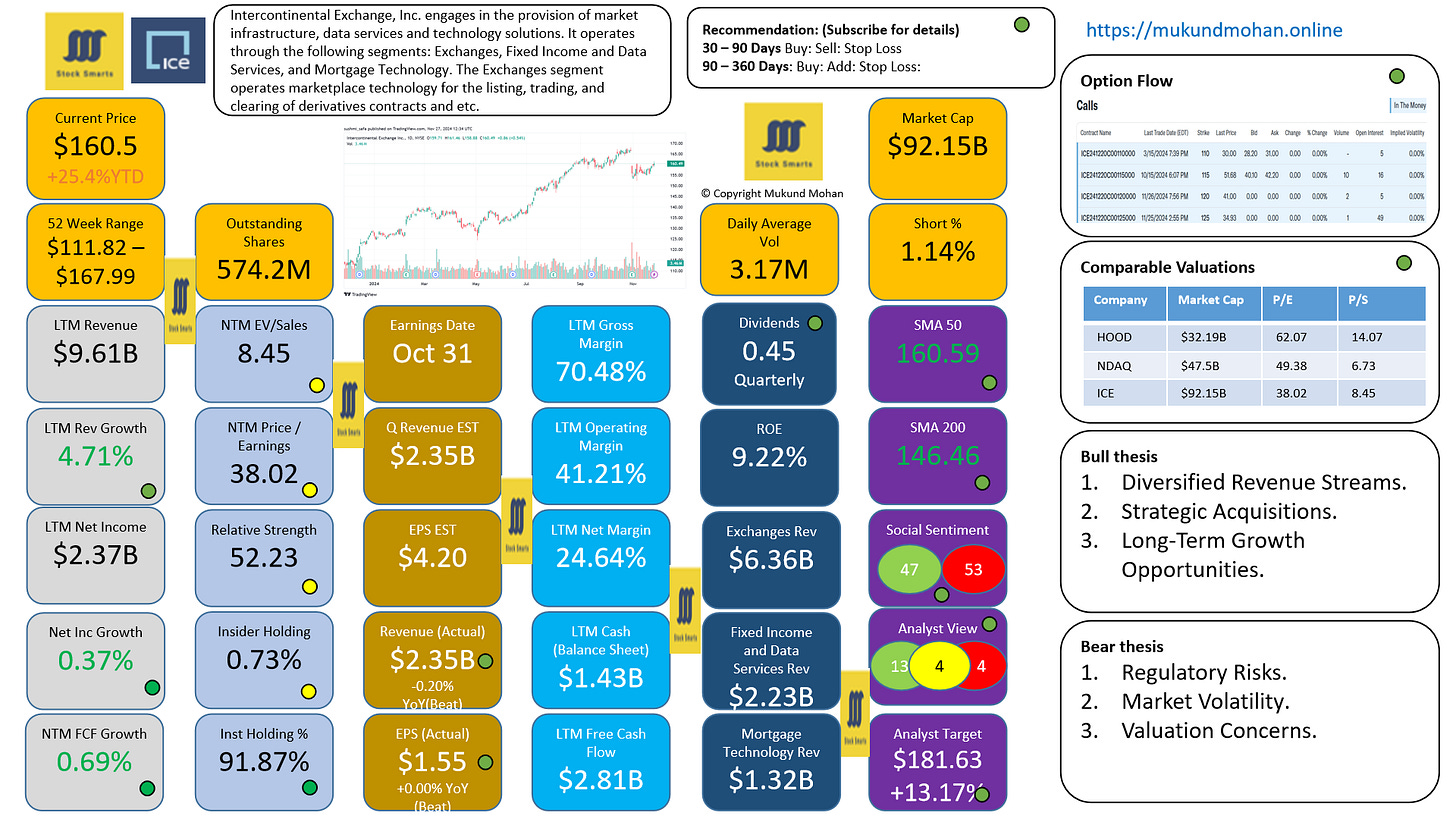

$ICE Intercontinental Exchange Inc Deep Dive and 2024 Outlook

The NASDAQ competitor has also been rising with the stock market

Intercontinental Exchange, Inc. (ICE), founded in 2000 by Jeffrey Sprecher, is a leading American multinational financial services company headquartered in Atlanta, Georgia. ICE has expanded its operations to include diverse financial products and services across global markets.

ICE operates multiple regulated exchanges, including the New York Stock Exchange (NYSE), and provides clearing houses for various asset classes such as energy, agriculture, and financial securities. Its offerings encompass futures exchanges, cash equities, over-the-counter (OTC) markets, and derivatives clearing services. The company serves a wide customer base, including financial institutions, corporations, and government entities.

It provides advanced analytics and risk management solutions through its ICE Data Services division, which delivers critical market data to support trading and investment decisions. The company's growth strategy has largely been driven by acquisitions of other exchanges and technology firms, which have enhanced its capabilities and market reach.

The big questions for Intercontinental Exchange Inc company and the stock in 2024?

How will regulatory changes affect ICE's trading operations?

What strategies will ICE implement to enhance its technology offerings?

Can ICE sustain its growth in the face of economic fluctuations?

How will acquisitions shape ICE's future?

Keep reading with a 7-day free trial

Subscribe to Stock Smarts to keep reading this post and get 7 days of free access to the full post archives.