$HSBC HSBC Holdings plc Deep Dive and 2024 Outlook

The bank is still trying to recover from a long slump

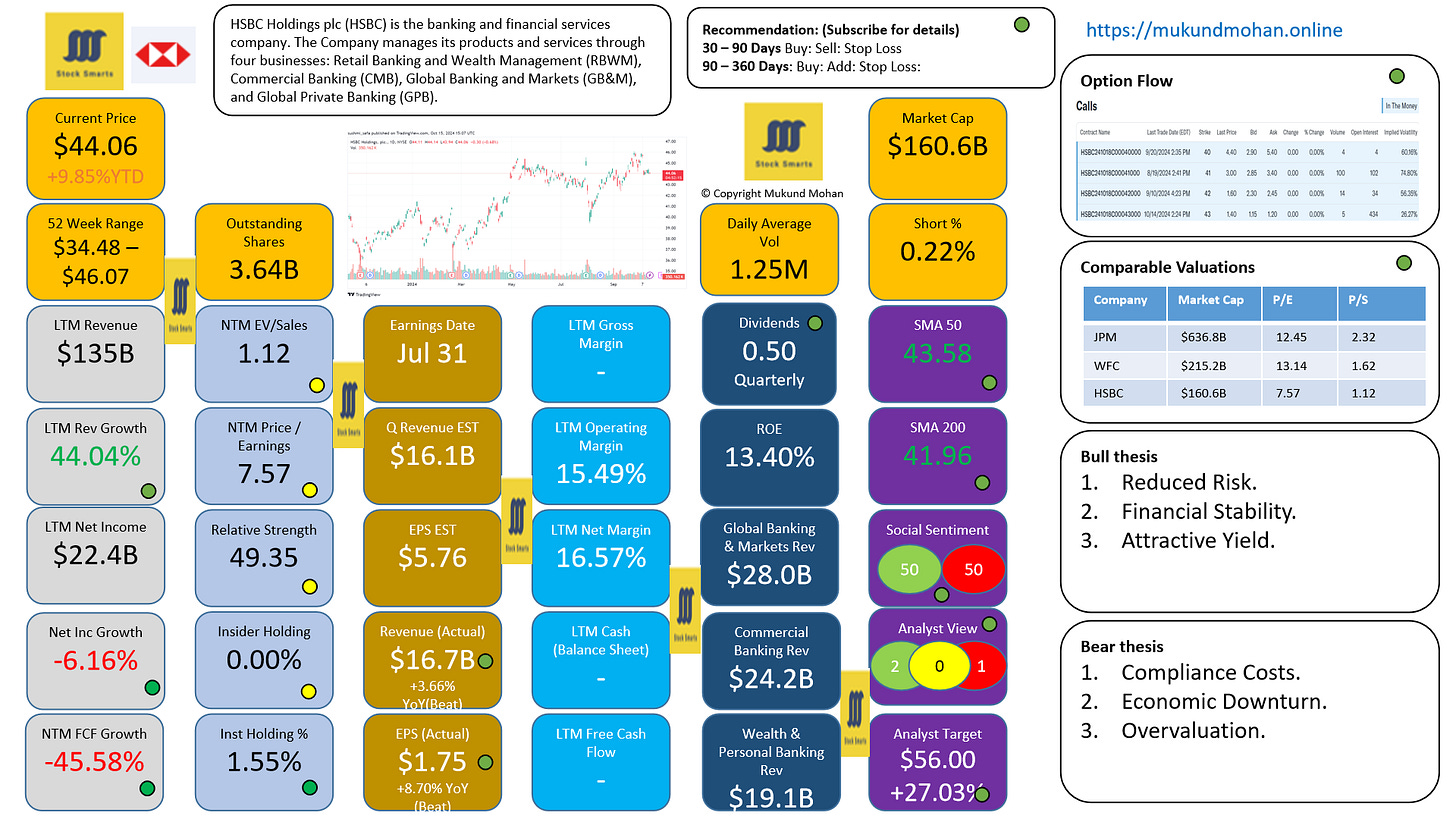

HSBC Holdings plc is a global banking and financial services organization founded in 1865. They are headquartered in London, as the Hong Kong and Shanghai Banking Corporation, was established to facilitate trade between Europe and Asia. The bank's organizational structure includes three primary business groups: Commercial Banking, Global Banking and Markets, and Wealth and Personal Banking, allowing it to cater effectively to various customer needs.

HSBC's technology plays a crucial role in delivering innovative solutions and enhancing customer experience. The bank invests heavily in digital platforms, mobile banking apps, and data analytics to provide efficient and secure services. HSBC's customer base encompasses individuals, businesses, and institutions, with a strong focus on serving the needs of international customers.

HSBC is investing heavily in digital banking innovations to enhance customer experience and security. With a vast network spanning over 6,900 offices in 84 countries, HSBC caters to millions of customers worldwide. The bank's market presence is extensive, with significant operations in Asia, Europe, the Americas, and the Middle East. HSBC leverages its global network to facilitate international trade, investment, and financial flows.

The big questions for HSBC Holdings plc Limited and the stock in 2024?

What is the impact of recent disposals on financial health?

How will interest rate fluctuations affect profitability?

What are the implications of geopolitical tensions?

How will digital transformation initiatives progress?

What will be the dividend policy moving forward?

Keep reading with a 7-day free trial

Subscribe to Stock Smarts to keep reading this post and get 7 days of free access to the full post archives.