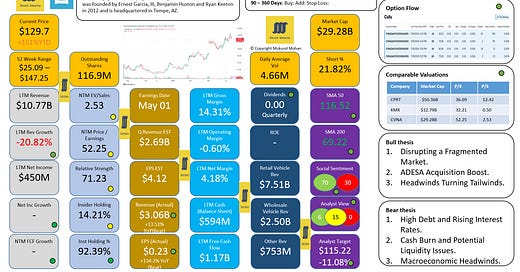

$CVNA Carvana Co Deep Dive and 2024 Outlook

The used car purchase company is coming off its lows and growing

Carvana Co, founded in 2012 by Ernie Garcia III, is a disruptive online platform revolutionizing the used car buying experience. The company aims to simplify and enhance the process by allowing customers to buy, sell, and trade vehicles entirely online. Carvana's technology includes sophisticated algorithms for vehicle valuation and proprietary systems like CARLI, which streamlines vehicle inspection and reconditioning processes, improving operational efficiency and reducing costs.

The company targets a massive, fragmented market, capitalizing on the inefficiencies of traditional dealerships. Carvana offers a vast inventory, with over 37,000 vehicles available for customers to browse and purchase from their devices. The buying process is designed to be seamless, often completed in under ten minutes, and includes features like next-day delivery in select markets. Carvana's customer base primarily consists of tech-savvy individuals seeking convenience and transparency in their car purchases.

The big questions for Carvana Co and the stock in 2024?

Can Carvana navigate the rising interest rate environment?

How will the ongoing supply chain issues impact Carvana's ability to source vehicles?

Will Carvana be able to maintain its profitability as it scales its business?

What is the impact of competition from traditional car dealerships and other online car retailers?

How will changes in consumer preferences for car buying impact Carvana's business model?

Keep reading with a 7-day free trial

Subscribe to Stock Smarts to keep reading this post and get 7 days of free access to the full post archives.