Comprehensive Novo Nordisk A/S (NVO) Stock Analysis: Fundamentals and Technicals

What does 2024 have in store for the Obesity drug maker of Ozempic and Wegovy have in store?

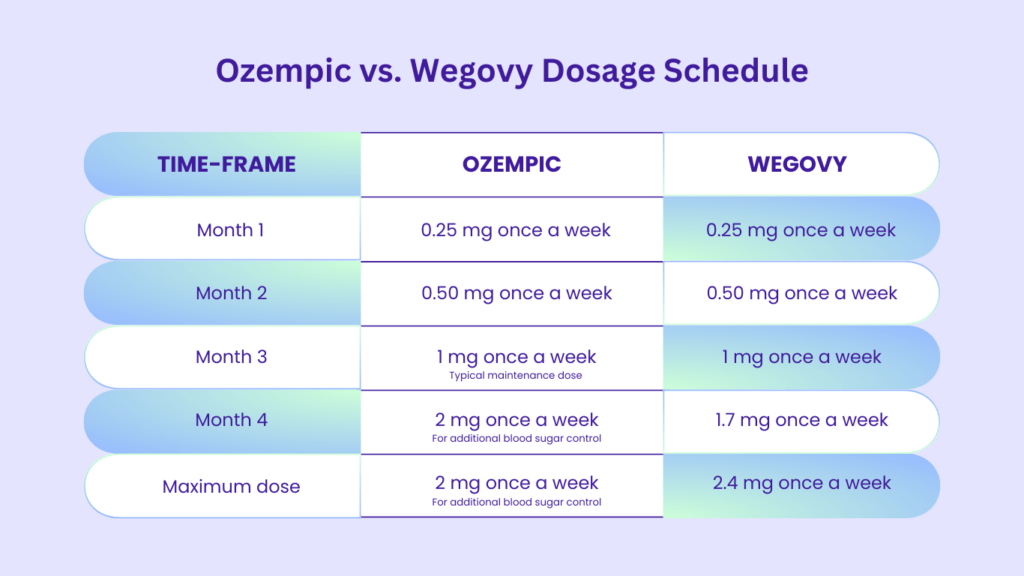

Novo Nordisk is a pharmaceutical company. They make Ozempic is used to treat type 2 diabetes and prevent major cardiovascular problems in certain patients, and Wegovy is used for weight loss and long-term weight management.

The five big questions for Novo Nordisk A/S stock in 2023 and into 2024 are:

Will the significant sales for Ozempic and Wegovy and profit growth projected for 2023 be sustained in 2024?

How will Novo Nordisk address the potential for smaller rivals, such as Zealand Pharma, to outperform the company in 2024?

What do the fundamental and technical analyses reveal about Novo Nordisk's stock, including factors such as industry performance, company-specific growth, and market trends?

The exponential growth witnessed by Novo Nordisk in 2023 has raised questions about the sustainability of this growth in 2024 and beyond. However, the company has raised its sales outlook for 2023, projecting sales growth of 32-38% and operating profit growth of 40-46%.

Novo Nordisk's high growth rate for a company of its size presents a significant challenge, necessitating increased efforts to maintain growth.

Novo Nordisk's exponential growth witnessed in 2023 can be attributed to several factors, including a strong performance in diabetes care sales and the company's strategic aspirations. However, sustaining this growth into 2024 and beyond will depend on various factors, such as:

Maintaining sales momentum: Novo Nordisk's sales growth has been impressive, with a 33% increase in the first nine months of 2023. The company needs to continue driving sales growth in the coming years.

Operating profit growth: Novo Nordisk's operating profit growth has also been robust, with a 37% increase in the first nine months of 2023. The company needs to maintain or even increase this growth to support its ambitious targets.

Market share expansion: Novo Nordisk has been successful in gaining market share in both international operations and the US. The company needs to continue expanding its market presence to sustain its growth.

Wall Street predicts that the stock price will start at $122.17 in November 2024, with a maximum of $126.76 and a minimum of $107.98, and an average price of $118.57 at the end of the month.

JP Morgan predicts that the stock price will hit $110 by the end of 2024. Piper Sandler provides a median target of 750.00 DKK (approximately $110 USD) for Novo Nordisk's stock price, with a high estimate of 875.00 DKK (approximately $128 USD) and a low estimate of 360.00 DKK (approximately $53 USD).

Novo Nordisk faces the challenge of smaller rivals, such as Zealand Pharma, potentially outperforming the company in 2024. Analyst estimates indicate that Zealand Pharma's stock could outperform Novo Nordisk again in 2024. Zealand Pharma has experienced significant market value growth, outpacing Novo Nordisk in 2023. Despite this, Zealand Pharma's market value is still significantly smaller than Novo Nordisk's, and the two companies have strong links, including past and present managers with employment history at Novo Nordisk.

The fundamental and technical analyses of Novo Nordisk's stock reveal several key factors that may influence its performance in the coming years:

Fundamental Analysis:

Growth: Novo Nordisk has experienced significant sales growth in recent years, with a 25.7% increase in sales in 2022. The company's sales growth is expected to be in the range of 6-10% in International Operation.

Profitability: Novo Nordisk's operating profit growth has been impressive, with a 28% increase in 2022. The company's earnings per share (EPS) forecasts for the upcoming fiscal year have been gradually revised upwards.

Debt: Novo Nordisk's net debt increased by 12.75 billion DKK in 2022. The company's debt-to-equity ratio stands at 0.67.

Technical Analysis:

Relative Strength Index (RSI): As of December 15, 2023, Novo Nordisk's RSI is at 57.18, indicating a neutral position in the short-term.

Moving Average Convergence Divergence (MACD): As of December 15, 2023, Novo Nordisk's MACD is at 1.12, suggesting a potential upward trend

.