$ASAN Asana Inc Deep Dive and 2024 Outlook

Long term consolidation is still in play for the stock that's moved nowhere

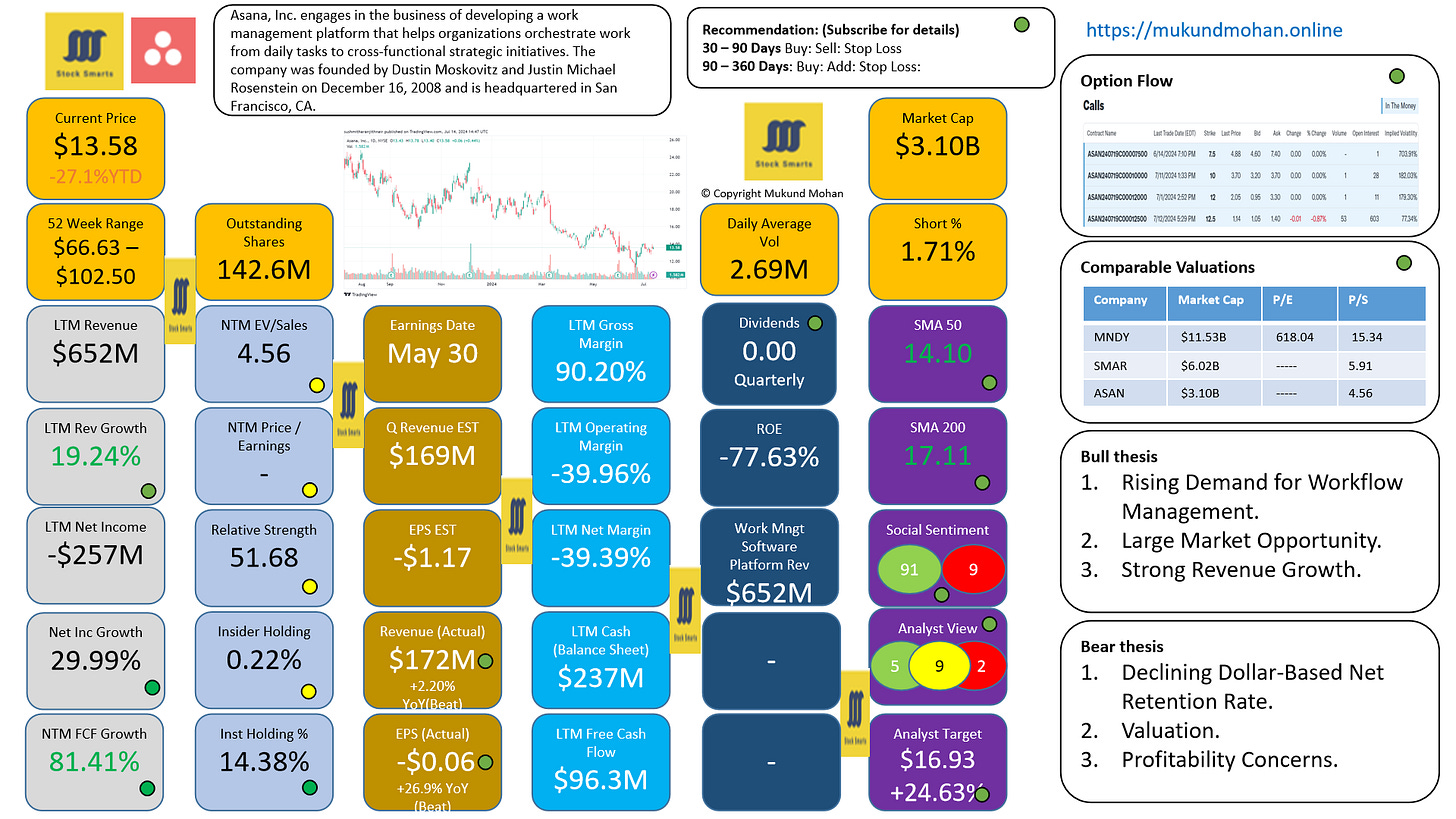

Asana Inc. was founded in Founded in 2008, It creates work management software to improve team collaboration and productivity. Their flagship product, also called Asana, is a web-based platform that allows teams to assign tasks, track progress, and share files. Asana utilizes a freemium model, offering basic features for free and premium tiers with additional functionalities for paying customers. Their target market includes businesses of all sizes, focusing on knowledge work. Marketing teams, design agencies, and software development companies are some of their key customer segments. Asana competes in the project management software market, facing established players like Trello and Microsoft Project.

Asana's technology revolves around a central platform integrating various project management functionalities. Users can create tasks, assign deadlines, and track progress visually. Communication features allow for discussions and updates within the platform. By centralizing project information and fostering collaboration, Asana helps teams stay organized and efficient.

The big questions for Asana and the stock in 2024?

Can Asana continue its strong revenue growth in a challenging macroeconomic environment?

Will Asana's focus on operational efficiency and profitability pay off?

Can Asana continue to win large enterprise customers and expand within existing accounts?

Will Asana's investments in go-to-market strategies and talent pay off?

How will Asana's valuation and stock price perform?

Keep reading with a 7-day free trial

Subscribe to Stock Smarts to keep reading this post and get 7 days of free access to the full post archives.